Maybe you’re living paycheck to paycheck like the majority of the population, but then something unexpected happens.

A surprise expense such as a car breakdown or worse, an illness knocks on your door. Life is already stressful enough, and the last thing you want is an unexpected financial obligation. You need a way out asap. What do you do?

The good news is…

There are payday loans from online direct lenders. These lenders throw you a lifeline by loaning you the much-needed cash. In this post, we will dig deeper into what they are, their advantages, and even how they lend you money.

So, without further ado, let’s get this show on the road.

- 1 What are online direct lenders?

- 2 How do online loans from direct lenders work?

- 3 The advantages of a direct lender

- 4 What are the requirements for direct payday lenders?

- 5 How much interest will you be paying?

- 6 How do you apply for a payday loan from direct lenders?

- 7 Are you ready to take a payday loan from an online direct lender?

What are online direct lenders?

Online direct lenders are web-based creditors that offer you money directly without involving intermediaries. You simply make an application, the lenders review it, and if you qualify, they lend you money. It’s a smooth process, and it’s this personal touch that makes it possible to nurture an ongoing relationship between the lender and the borrower.

In case you’re wondering…

How do online loans from direct lenders work?

It’s simple. You just need to be connected to the internet. You can then visit your favorite direct lender’s website and make an application. A review is later made on your request, and if you qualify, the online loan is transferred to your account.

Word of caution: Due to different state regulations, the rates offered by the direct lenders will tend to vary in each state.

But you know what else?

The advantages of a direct lender

Getting a payday loan from an online direct lender has its fair share of benefits. Let’s have a look:

- It’s a one-stop-shop

Usually, when applying for a loan, multiple parties are involved. As a result, it can get frustrating because you won’t know when the loan offer is coming until a loan agreement comes your way.

Direct lenders, on the other hand, simplify the whole process. They handle your loan application, disbursement of funds and your loan repayment. It’s a speedy and painless process, which is what you desire, right?

- You’re spoilt for choice

When you face an urgent financial need, it’s easy to make a rash decision. You don’t have to take only what is available but consider other options too.

That’s the cool part about direct lenders. They serve you an array of choices by giving you the leeway to find what suits your specific financial needs.

As a result, you can compare loan rates and terms and make an informed choice.

- The safety of your personal information

- Who is reputable and who isn’t?

It’s easy to recognize a reputable online lender from their website. A licensed lender will have a link that shows their licenses and what states they are allowed to operate in. There will also be in display their rates and terms to help save you from extortion since you will have the freedom of choice.

In other words, you will be able to separate the wheat from the chaff.

Imagine receiving a creepy email from a weird company address or, even worse, calls from a funny-speaking sales guy. It’s disturbing, right?

You don’t want sensitive information like your contacts or even bank details falling into the wrong hands. Since an online lender handles the whole process, it’s easy to secure your personal details from third parties who might otherwise use it in dodgy ways.

Now, let’s say you want to get a payday loan from an online lender, what are some of the things that are required?

Let’s see.

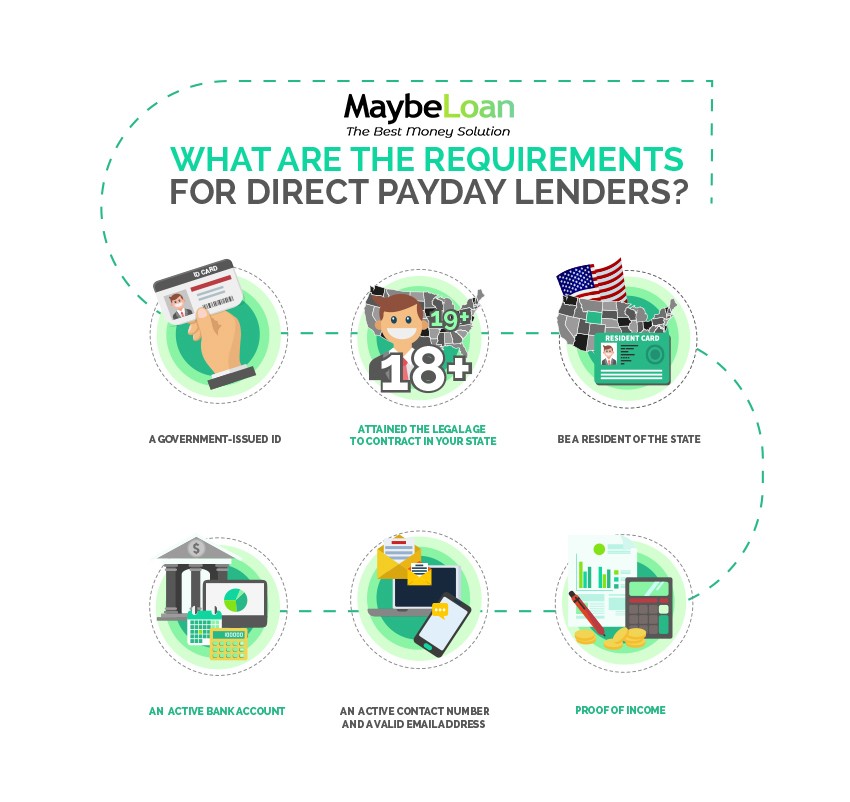

What are the requirements for direct payday lenders?

Every direct lender has a different set of requirements, but of course, some are common. Let’s see what they are:

- A Government-issued ID

- Attained the legal age to contract in your state

- Be a resident of the state that the loan product is being offered

- An active bank account

- Proof of income

- An active contact number and a valid email address

How much interest will you be paying?

Several factors determine how much interest you will be charged.

The most common is the state you live in. Different lenders will tend to offer varying rates in a given state, so it’s only wise you carry out due diligence before you commit to a particular one.

And finally…

How do you apply for a payday loan from direct lenders?

Once you have settled for a direct lender, you can go ahead and apply for a payday loan. Mostly, it’s a straightforward online process, but before applying make sure that the loan suits your needs and your ability to repay. Late repayments always attract penalties and this could put you into deeper financial trouble.

Let’s now find out how you apply for a payday loan. This is the process:

- Choose the loan amount Here you choose the amount you intend to borrow and also the expected repayment period. At this point, some lenders will give you a repayment estimate.

- Polish up your application

Here you will be asked to fill out your particulars such as your income and bank account details. The information is reviewed, and feedback shared later.There’s a catch though, as the feedback time varies with the lender. Some do it instantly while others take their time. Eventually, if you’re qualified, you accept the loan and even sign documents electronically.

- Getting your money

The time taken to disburse funds differs from different lenders. The good thing is that you will be briefed on how long it will take during the application process.

Are you ready to take a payday loan from an online direct lender?

The unexpected will always happen, and that’s something we have to accept. The big question then is, when it shows up, how prepared will you be?

With the resources in this post, you don’t have to panic anymore when a financial obligation creeps on you. Just take a stroll down the online streets and knock on the door of your preferred online direct lender in just 5 minutes.

Is this procedure of online direct lending under the control of MaybeLoan? How can I be sure that I wouldn’t be withdrawn extra money, apart from daily/monthly payment, indicated in the contract?

I wonder if direct lenders are only individuals or they can be legal entities. Does it somehow influences on the terms of contract?

Is it possible to become one of your direct lenders? I have a great capital and want to turn my money over on a constant basis.