Don’t you just hate it when an emergency pops up mid-month? You cower in fear that you don’t have the cash to cover the crisis.

Well, you don’t have to be.

In this post, we will talk about payday loans with no credit checks.

Let’s get started.

- 1 What are payday loans with no credit checks?

- 2 What are no credit check loans?

- 3 The benefits of payday loans with no credit checks

- 4 The disadvantages of payday loans with no credit checks

- 5 Why do people search for no credit check loans

- 6 What sort of loans have no credit checks?

- 7 How to apply for a payday loan with no credit check

- 8 What’s stopping you?

What are payday loans with no credit checks?

A payday loan is a short-term borrowing generally used to cater for emergency expenses such as an illness or even car repair. The repayment is usually due in a few weeks or even a month because that’s when the lender assumes will be your next payday.

On the other hand, a payday loan with no credit check means that the lender won’t be visiting the famed credit reporting agencies to check up on your ability to repay the debt.

But that’s not all…

What are no credit check loans?

This is a loan whereby a lender approves a borrower’s loan application without conducting a credit check (hard check). As a result, no credit check loans are attractive to borrowers who have emergencies because the repayment is mostly due after your payday.

The application process is mainly painless, and in some cases, the borrower can receive the loan on the same day they apply. This efficiency comes at a price though, especially when you are late in making repayments. Due to the high interest rates, the cost can quickly spiral out of control.

The “no credit check” label can be a little bit misleading even if some lenders don’t perform credit checks at all. What most online lenders do instead, is a soft check.

So,

What’s a soft credit check?

A soft credit check is a background check on your credit worthiness that doesn’t require your authorization. This process gives the lender an overview of your ability to pay without affecting your credit. At most, it involves checking your information such as proof of income, bank account details, a valid email address, and a working phone number.

On the other hand,

What’s a hard credit check?

A hard credit check involves checking your financial history with the traditional credit bureaus. It’s a lending process mostly used by banks and one that affects your credit score.

Now let’s look at the advantages of payday loans with no credit checks.

The benefits of payday loans with no credit checks

Whenever there are no credit checks on payday loans, there are bound to be advantages. Let’s find out what they are:

- It’s a speedy process – Since there is little or no paperwork involved or even hard checks being conducted, valuable time is saved. It’s the least you want, especially when faced with a financial emergency. You just head to an office or online, fill out a form, and that’s it. The money will be in your hands in no time.

In addition, the possibility of having the loan amount within a day makes it a fast process.

- You maintain your credit score – Whenever you take a payday loan with no credit check, then you are exempted from the dreaded hard check. In that case, you get to keep your credit score intact.

- Spending freedom – If you have a poor credit score, then you can be limited in how you use the loan money. For payday loans with no credit checks, you can use the cash as you wish.

- Meeting an urgent financial need – Whenever you’re short of money in the middle of the month, a no credit check payday loan comes to your rescue.

Let’s now have a look at the shortcomings.

The disadvantages of payday loans with no credit checks

In as much as there are numerous advantages of payday loans with no credit checks, there is always the other side of the coin. Let’s dive in:

- High interest rates – Since no credit check loans are unsecured, lenders factor in the risk by charging high interest rates as there’s a considerable chance of defaulting on the loan. Besides, a delay in repayment becomes very expensive, and this can be tragic for a person living paycheck to paycheck.

- The short term curse – Due to the high interest rates, it’s only reasonable that the no credit check loan be used for the short term. Over the long haul, the repayments can shoot through the roof, burning more holes in your pockets.

Why do people search for no credit check loans

Several reasons could be the motivation behind why people apply for no credit check loans. Let’s check them out:

- A poor credit history – Maybe life happened, and you had credit issues – bankruptcy, defaulting on multiple payments or even an extensive credit search by various lenders. As a result, no lender is willing to welcome you to their house apart from a few.

- The privacy of your credit history – Usually, when seeking a loan, a lender will check out your credit file to determine if you qualify for a loan. This makes some people cringe and consider it a breach of their privacy.

- Credit status improvements – Some people turn to no credit check loans when they can’t secure loans from the usual lenders. As a result, by making timely and full repayments, they can improve their credit status.

And now…

What sort of loans have no credit checks?

Generally, most loans have a “no credit check” provision. Below, we will have a look at the popular ones:

- Personal and payday loans – These are the most common and usually range from a few hundred to thousands of dollars. Since personal and payday loans are unsecured, they tend to charge high interest rates and incorporate a short repayment duration.

- Title loans – These are loans that require an asset such as a car to use collateral. As a result, it’s not necessary to conduct credit checks since title loans are secured.

Please make no mistake about it; the loan terms will vary depending on the lender.

- Installment loans – These are loans that are approved for a specific amount and are subject to increase contingent on repaying the current loan. What’s more, consistency in making repayments guarantees you an increase in the future loan amount.

And finally, the rubber meets the road.

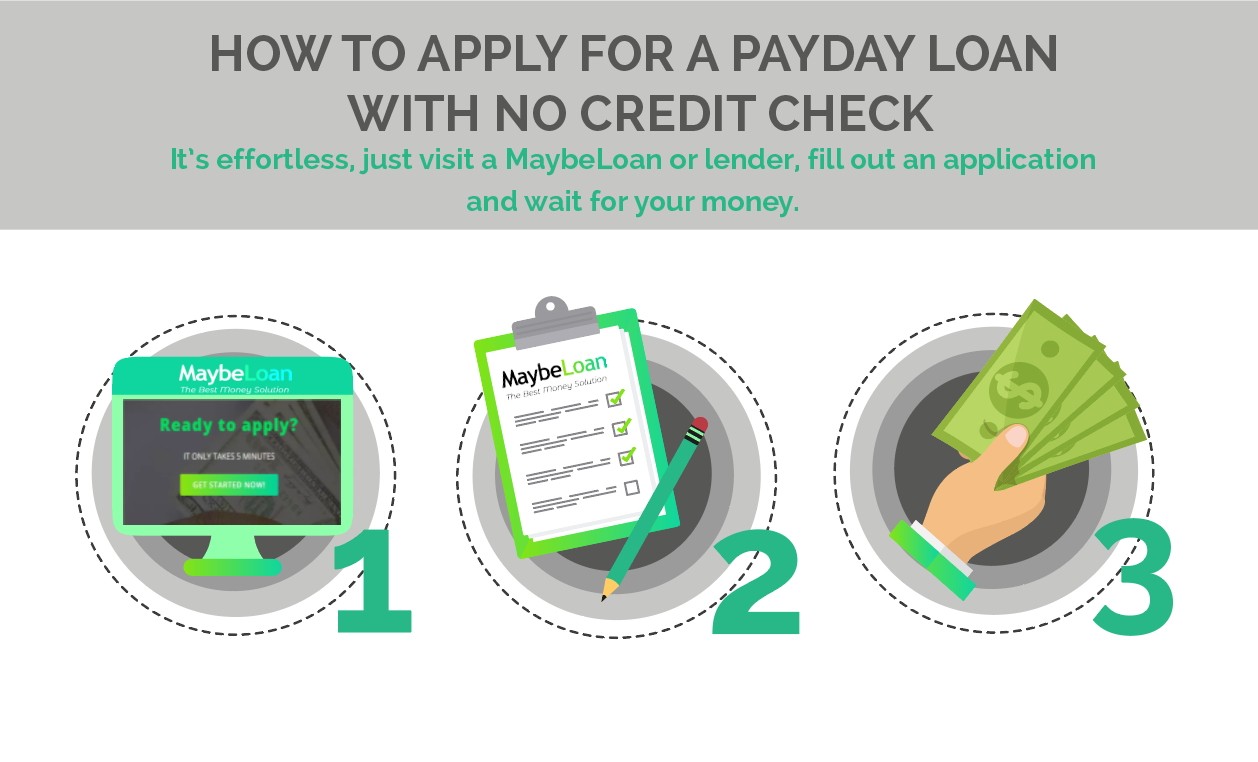

How to apply for a payday loan with no credit check

It’s effortless, just visit a lender, fill out an application and wait for your money.

What’s stopping you?

No matter how bad your credit history is, it’s okay. You don’t have to be ashamed about it. In this post, we have talked about payday loans with no credit checks, and that’s what you need.

Pick yourself up, dust off the self-pity, and make that bad credit loan application.

I had such an emergency pop-up. I am used to living within my means, spending each cent of monthly salary. Recently, I’ve faced with a car accident and I hit my vehicle. I needed to cover lots of expenses not even having a single dolar in a stash. Luckily, I took a payday loan and refund the money soon. Nevertheless, I advise you to save up to avoid not being able to repay.

Does a company reassure itself using collateral or guarantor? I wonder, cuz it much complicates the procedure and I don’t wanna wait a lot till I withdraw money from my account.

Is it possible to endure a payday loan or should I directly take another kind of loan with an extended repayment due date?